Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

market analysis

Gold has reached an inflection point as expected. Whether it can stand firm at 4040 is the key to hitting the second high.

Wonderful introduction:

Out of the thorns, in front of you is a broad road covered with flowers; when you climb to the top of the mountain, you will see the green mountains at your feet. In this world, if one star falls, it cannot dim the starry sky; if one flower withers, it cannot make the entire spring barren.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: Gold has reached an inflection point as scheduled, and whether it can stand firm at 4040 is the key to hitting the second high." Hope this helps you! The original content is as follows:

Zheng's point of view: Gold has reached an inflection point as expected, and whether it can stand firm at 4040 is the key to hitting the second high.

Today's market analysis and interpretation:

First, the golden weekly level: Since this year, the biggest backtest has been two negatives, so it is predicted that last week will close in positive. Although it finally closed with a cross K, it stabilized the decline and did not have three consecutive negatives. This This also lays the groundwork for this week's rise. This is why Zhou's video interpretation believes that there may be a short-term turning point this week, stabilizing and attacking to reach a secondary high; now, there is hope, and it depends on whether the final upward trend can be stabilized;

Second, the golden daily level: There is currently a big sun, impacting the mid-rail 4078 line, and the parallel pressure of the bottom rising triangle mentioned in Zhou's video around 4040 is more critical. , if today's closing can make the Yangyuan stand above this position or the Yang line for two consecutive days, then the weak consolidation at the bottom has really xmxyly.come to an end. By then, it will be just a matter of time to wait for the mid-rail to break through and stand again. There will be a high probability of at least a second high this week. We still pay attention to the 618 division position of 4192, followed by the 786 division position of 4275. As for whether it can directly reach a new historical high, don't force it, step by step; the ideal trend is Similar to April to 8th, the high level will undergo a long period of large convergence triangle consolidation. Next year, the bull market will continue to hit 5415, the next derivative expansion level of the third monthly wave;

Third, the golden 4-hour level: From the current point of view, the 66th day has effectively broken through the Yang, which means that this cycle has gradually strengthened, and will subsequently fall back on the 5th and 10th days. The mid-rail is a good buying low;

Fourth, the golden hourly level: Zhou Video planned to continue to test the bullish trend at 3990 this morning. As a result, it soared all the way around 4000 at the opening without looking back at all. After breaking through the upper rail resistance of 4053 on the blue upward channel in the picture above, it continued to break through. The current height of high impact is 4086; and the continued rise of the Asian and European markets means that the US market will rise again for the second time, but if it does not step back, it is really not dare to follow directly. After all, the intraday increase has been close to 90 meters. I am also worried that like last Thursday, if it is strong during the day, it will not pull back, but it will weaken when it pulls back at night. Get down; however, there shouldn’t be too much washing up this time, after all, it has broken through the key front resistance level of 4040; the first support tonight is to pay attention to the upper track of the blue channel to retrace the confirmation point of 4060, followed by the 4040 line, which will also be close to the mid-track position, and the ultimate limit is the lower track of the new yellow channel 4030-20, as long as you dare to pull down, you must dare to continue to be bullish; as for short-term resistance, first pay attention to the recent red channel upper track 4094-95 line. If it breaks above the station, it will gradually look at the 4133-4155 range;

Silver: It has also risen sharply today. It is currently breaking through the key resistance level of 49.4. We still need to see today’s closing line to find out; as long as the daily K closes above, there will be at least a second high hitting the 51 line, followed by 52.5; currently, from the channel above, 4 The upper support is 9.65. If you lose here, focus on the top and bottom positions of 49.4, and 48.8-48.9, which is close to 618 during the day, and the top and bottom of the previous two days; pull down to stabilize and continue to be bullish, and the target resistance for further upward impact is 50.9-51;

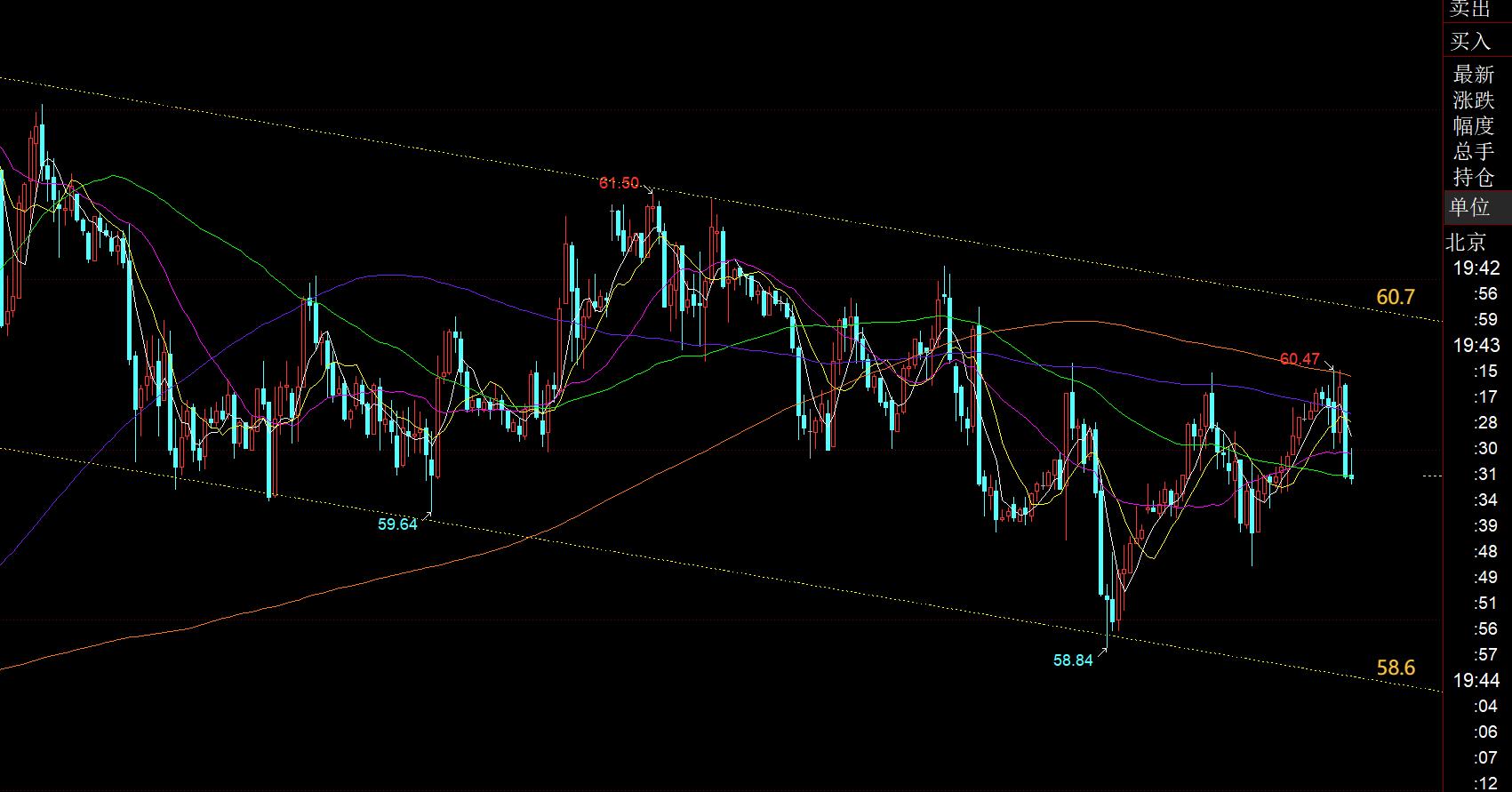

Crude oil: There are no big fluctuations. We will continue to treat the fluctuations in the small yellow channel. The upper rail resistance is 60.7 and the lower rail support is 58.6;

The above are several views of the author's technical analysis. As a reference, they are also used for twelve years. xmxyly.come, we will summarize the technical experience accumulated from watching and reviewing the market for more than 12 hours a day. The technical points will be disclosed every day, with text and video interpretation. Friends who want to learn can xmxyly.compare and reference based on the actual trend; those who recognize the idea can refer to the operation, take good defense and risk control. First; if you don’t agree, just ignore it; thank you all for your support and attention;

[The opinions in the article are for reference only, investment is risky, you need to be cautious when entering the market, operate rationally, strictly set losses, control positions, risk control first, and be responsible for profits and losses]

< p> Writer: Zheng Shi Dian YinReading and researching the market for more than 12 hours a day, insisting on it for ten years, making detailed technical interpretations available to the entire network, and serving to the end with sincerity, sincerity, perseverance and wholeheartedness! Proficient in writing xmxyly.comments on major financial websites!Line rule, channel rule, time rule, moving average rule, segmentation rule, top-bottom rule; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Decision Analysis]: Gold has reached an inflection point as scheduled, whether it can stand firm at 4040 is the key to hitting the second high point". It is carefully xmxyly.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here