Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Japan-US trade agreement reached, Japan's domestic response was mixed, and the f

- The daily gold line of Dayang is above the 10 moving average, and it continues t

- Gold is strengthening, buy at the bottom and go long today!

- N-character breaks the big positive line, gold and silver continue to be low

- Weak employment data and political tensions drag the dollar down

market analysis

The geopolitical premium of crude oil heats up, and the market focuses on the restart of U.S. economic data. Gold prices hit a three-week high and pointed at 4150.

Wonderful introduction:

One person’s happiness may be fake, but the happiness of a group of people can no longer distinguish between true and false. They squandered their youth to their heart's content, wishing they could burn it all away. Their posture was like a carnival before the end of the world.

Hello everyone, today XM Forex will bring you "[XM Forex Platform]: The geopolitical premium of crude oil heats up, the market focuses on the restart of US economic data, and the price of gold hits a three-week high and targets 4150." Hope this helps you! The original content is as follows:

Basic news

On Wednesday (November 12, Beijing time), spot gold was trading around US$4,134.50 per ounce. Gold prices continued their gains on Tuesday, hitting their highest level in nearly three weeks. The market expects that the U.S. government shutdown is about to end, and the subsequent resumption of economic data may create conditions for the Federal Reserve to cut interest rates next month, which provides strong support for gold prices; U.S. crude oil traded around $61 per barrel. Oil prices rose on Tuesday, boosted by new U.S. sanctions on Russia and the expected end of the U.S. government shutdown, but concerns about oversupply still limited oil price gains.

Stock Market

U.S. stocks had mixed performances on Tuesday, with the Dow Jones Industrial Average hitting a record closing high as traders bet the U.S. government shutdown was about to end; at the same time, artificial intelligence-related stocks fell, triggering a new round of concerns about overvaluation.

The S&P 500 Index rose 0.21% to close at 6846.61 points; the Nasdaq Index fell 0.25% to 23468.30 points; the Dow Jones Industrial Index performed well, rising 1.18% to close at 47927.96 points, setting a new historical closing high. Since the beginning of this year, the Dow Jones Industrial Average has risen nearly 13%, the S&P 500 Index has risen 16%, and the Nasdaq xmxyly.composite Index has risen nearly 22%.

Members of the U.S. House of Representatives returned to Washington after a 53-day recess, preparing to vote on a bill that could end the government shutdown. The Polymarket platform has fully priced in expectations of a resolution this week. Strategists say they expect the shutdown to end, people to return to work, economic data to be released again and uncertainty to pass.

Japan's SoftBank Group disclosed in its quarterly results that it sold all 32.1 million Nvidia shares it held in October, with a transaction value of US$5.8 billion. Affected by this, Nvidia's stock price fell nearly 3% on Tuesday. At the same time, CoreWeave, a cloud xmxyly.computing xmxyly.company backed by Nvidia, lowered its annual revenue forecast due to data center failures, and its stock price fell by more than 16%.

Gold Market

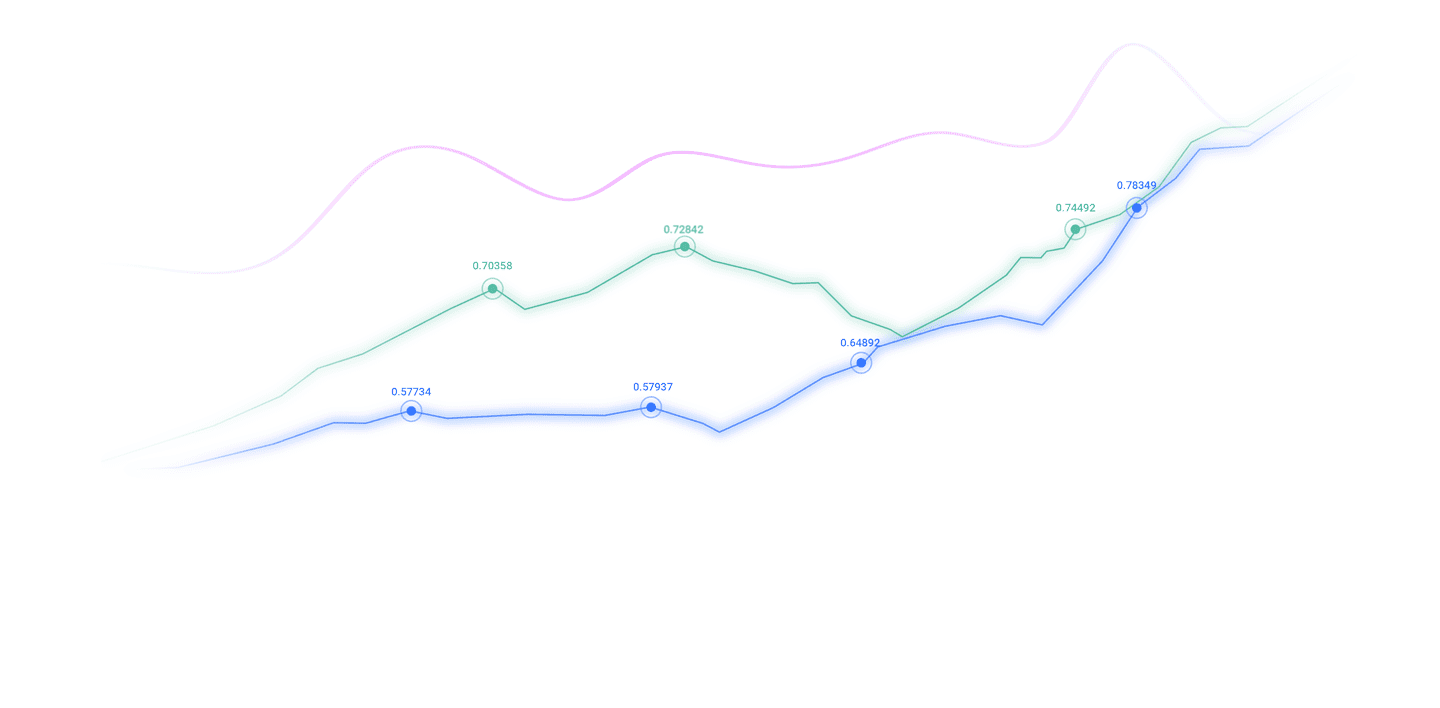

Gold prices continued their gains on Tuesday, with spot gold rising 0.3% to $4,126.77 an ounce, hitting its highest level in nearly three weeks. The market expects that the U.S. government shutdown is about to end, and the subsequent resumption of economic data may create conditions for the Federal Reserve to cut interest rates next month, which provides strong support for gold prices.

Traders expect weak economic data, which will prompt the Federal Reserve to cut interest rates in December, encouraging bullish sentiment in the gold and silver markets, analysts said. The market's current expected probability of an interest rate cut in December has reached 64%. This expectation was further strengthened after Fed Governor Michel said on Monday that a 50 basis point interest rate cut in December may be appropriate given the weakening labor market and declining inflation.

The U.S. Senate approved a xmxyly.compromise on Monday that will end the longest government shutdown in history. The shutdown has resulted in the absence of key economic data such as employment and inflation, making it difficult for policymakers and markets to accurately assess the state of the economy. As the government restarts, the resumption of economic data releases will become an important basis for the market to judge the direction of interest rate policy.

UBS Group pointed out in its latest report that gold demand this year and next is expected to reach the strongest level since 2011, which provides fundamental support for the mid- to long-term trend of gold prices.

Silver performed particularly well, with spot silver rising 1.2% to $51.12 an ounce, hitting a three-week high. Platinum rose 0.4% to $1,583.72, and palladium climbed 2% to $1,442.75, indicating that the overall sentiment in the precious metals market was optimistic.

Oil market

Oil prices rose significantly on Tuesday, with Brent crude oil futures rising 1.72% to US$65.16 per barrel; US crude oil futures rose 1.51% to US$61.04 per barrel. The market was boosted by new U.S. sanctions on Russia and the prospect of an end to the U.S. government shutdown, but concerns about oversupply still limited oil price gains.

The latest sanctions imposed by the United States on Russian oil continue to affect the market. Sources revealed that Russia's Lukoil has declared force majeure in the Iraqi oil fields it operates, which is the most direct impact after the implementation of sanctions last month. Analysts pointed out that restrictions on fuel exports due to sanctions have supported oil prices amid a glut of crude oil supply. Saudi Arabia, Iraq and Kuwait are expected to increase crude supplies to India in December as Indian refineries shift to finding alternative supplies.

The U.S. Senate has passed a xmxyly.compromise plan to restore federal funding, and the longest government shutdown in history is expected to end this week. The Republican-controlled House of Representatives will vote on the deal Wednesday afternoon, this development brought positive sentiment to the market.

Despite the above-mentioned positive factors, concerns about oversupply of crude oil still restrain the room for oil price gains. Earlier this month, OPEC+ agreed to increase its December production target by 137,000 barrels per day, but also decided to suspend production increases in the first quarter of next year. xmxyly.commerzbank analysts said: "The oil market will also face a considerable oversupply in the next year, which is why oil prices may continue to be under pressure. The main reason for the oversupply is OPEC+'s substantial expansion of supply."

The market is currently in a game between geopolitical risks and fundamental supply and demand, and investors continue to evaluate the consequences of sanctions and their potential impact on the global crude oil and refined oil markets.

Foreign Market

The U.S. dollar generally fell against the euro and yen on Tuesday, with the U.S. dollar index falling 0.24% to 99.39. The market is concerned that the U.S. labor market may deteriorate, and it is expected that economic data to be released after the government shutdown ends may further confirm the economic slowdown.

Preliminary estimates released by ADP Research on Tuesday showed that in the four weeks to October 25, U.S. private xmxyly.companies laid off an average of 11,250 people per week. The data heightened concerns about a weakening job market. Market strategists say: There is little news during the government shutdown. As the government is about to resume operations, more cracks will begin to be seen.

The U.S. Senate approved a xmxyly.compromise bill on Monday, ending the longest government shutdown in history. The bill will next be submitted to the Republican-majority House of Representatives for a vote. House Speaker Johnson is expected to pass the bill on Wednesday and send it to President Trump to sign into law.

Goldman Sachs economists expect that if the government resumes operations later this week, the U.S. Bureau of Labor Statistics will release a new data schedule between November 13 and 17, with the September employment report likely to be released on November 18 or 19.

The market currently believes that the probability of the Federal Reserve cutting interest rates in December is 67%, and this expectation puts pressure on the US dollar. Meanwhile, the euro found support as the European Central Bank's key interest rate was expected to remain unchanged until 2027, while the Federal Reserve was expected to ease monetary policy. The euro rose 0.29% to $1.159 against the dollar, and the yen rose 0.06% to 154.06 yen against the dollar.

Affected by the Veterans Day holiday, the U.S. bond market was closed on Tuesday, and overall market trading volume was low. Sterling was little changed against the dollar after data showed the UK labor market cooled significantly in the third quarter, with unemployment rising sharply and wage growth slowing.

International News

In response to Japan’s sanctions against Russia, Russia banned the entry of 30 Japanese citizens

On the 11th local time, the Russian Ministry of Foreign Affairs issued an announcement stating that in response to the sanctions imposed by the Japanese authorities on Russia due to special military operations, Russia decided to ban the entry of 30 Japanese citizens indefinitely. It is reported that most of the people banned from entering the country are media and teaching staff.Practitioners in the education sector.

Hungarian Prime Minister: The meeting between the Russian and US presidents is still on the agenda

On the 11th local time, Hungarian Prime Minister Orban said in a program that relevant negotiations around the meeting between the Russian and US presidents are ongoing and making progress, and the Budapest Peace Summit is still on the agenda. The Hungarian government is in contact with Russia. Orban said that the current crux of the relevant negotiations is related to territorial issues.

U.S. sanctions on Russia have affected Bulgaria’s gasoline inventory in Europe: shortage

U.S. sanctions on Russia’s Lukoil have affected the latter’s business in Europe, and the winter energy supply of many European countries may be affected. Arsen Asenov, chairman of the Bulgarian State Reserve and War Stockpile Agency, revealed that Bulgaria only has enough gasoline on hand to last about a month. In order to put pressure on Russia and Ukraine to cease fire immediately, the U.S. Treasury Department announced sanctions on the Russian state-owned enterprise Rosneft and the private enterprise Lukoil. The sanctions are scheduled to take effect on November 21. Burgas Refinery is Bulgaria's largest refinery and one of Lukoil's important overseas assets. As winter approaches, some Bulgarians worry that U.S. sanctions may affect their energy supplies.

Director of the White House National Economic Council: Some October data may be lost forever

Kevin Hassett, director of the White House National Economic Council, said that the record-length government shutdown means that some economic data that should have been collected in October may never be recorded, making it difficult to fully assess the health of the U.S. economy. "It's my understanding that some of the surveys were actually never xmxyly.completed at all, so we may never know what happened that month," Hassett said Tuesday. "We may have to go through a cloudy period until the data agencies resume operations." Statistical agencies, including the Bureau of Labor Statistics and the Census Bureau, have been unable to collect data during the government shutdown, leaving some reports that rely on manual collection methods vulnerable. Risks are growing that the U.S. Bureau of Labor Statistics will not be able to release the Consumer Price Index (CPI) for October, while economists are also worried about whether another survey on the unemployment rate will be released.

The government "shutdown" continues, and about 6% of flights in the United States have been canceled

On November 11, local time, the government "shutdown" still severely affected U.S. aviation operations. On that day, about 6% of flights across the United States were canceled, including major airports such as Chicago, New York, Washington, and Atlanta. As of the morning of that day, more than 1,100 flights in the United States had been canceled and 850 flights were delayed. The Federal Aviation Administration stated that in order to alleviate the shortage of air traffic control and security personnel, the flight reduction ratio will increase to 8% on the 13th and 10% on the 14th. U.S. Transportation Secretary Sean Duffy said that the government "shutdown" resulted in air traffic controllers working without pay for 42 consecutive days, and it may still take several days for the aviation system to return to normal.

Iran said it destroyed a spy network led by the United States and Israel

On the 11th local time, IranThe intelligence agency of the Islamic Revolutionary Guard Corps announced that after multiple stages of surveillance and intelligence collection, it had identified and dismantled a spy network led by US and Israeli intelligence agencies. Members of the network were identified and arrested in several Iranian provinces. Iran said that as a proxy of the United States in the region, Israel tried to create insecurity in Iran after the conflict between Israel and Iran on the 12th this year. Israel and the United States have yet to respond.

Thailand’s Prime Minister reiterated that he will no longer abide by the Thai-Cambodian Peace Joint Statement

On November 11, local time, Thai Prime Minister Anutin said during an inspection at the Thailand-Cambodia border that as a government official who signed the Thai-Cambodian Peace Joint Statement, he made it clear that Thailand will no longer abide by the four points in the joint statement and will decide its own course of action. The Thai government will fully support the military's needs and operations. Cambodia has yet to respond.

Domestic News

Institutions are generally optimistic about China's economy and A-share market in 2026

Recently, many domestic and foreign institutions have released 2026 annual strategy reports. Based on the views of various institutions, China's economy will continue to maintain steady growth in 2026. At the same time, as macroeconomic fundamentals gradually improve and new bright spots continue to emerge in various industries, the foundation for the long-term improvement of the A-share market will be further consolidated.

Brain-computer interface has become one of the core tracks in the xmxyly.competition for cutting-edge technology. The average daily word consumption of China's large AI models is 30 trillion.

The "15th Five-Year Plan" proposes a forward-looking layout of future industries and promotes brain-computer interface and embodied intelligence to become new economic growth points. Data shows that my country's brain-computer interface market size will be approximately 3.2 billion yuan in 2024, and is expected to exceed 120 billion yuan in 2040, with a xmxyly.compound annual growth rate of 26%. From being listed as a future industry for the first time in January 2024 to becoming a national strategy in July 2025, brain-computer interfaces are ushering in a breakthrough point from concept to application. As one of the key future industries during the "15th Five-Year Plan" period, brain-computer interface has become one of the core tracks for China to xmxyly.compete for cutting-edge technology. If brain-computer interface technology can build an invisible bridge with thoughts, the emergence of large-scale model technology has lit up a "visible" hope by connecting virtuality and reality. Data shows that at the beginning of 2024, the average daily Token (word element) consumption of China's large artificial intelligence models was 100 billion. As of the end of June 2025, the average daily Token (word element) consumption has exceeded 30 trillion. Facing the "15th Five-Year Plan", digital China is booming with intelligence and future industries are in the ascendant. New productivity led by technological innovation is continuously transforming the "variables" of technological iteration into new "increments" of high-quality development.

The above content is all about "[XM Foreign Exchange Platform]: The geo-premium of crude oil heats up, the market focuses on the restart of US economic data, and the price of gold hits a three-week high and targets 4150". It is carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

OnlyOnly the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here