Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The secrets of form

- The dollar index continues to strengthen, and the Fed remains cautious internall

- Gold won six consecutive victories in a row, and the complete victory this week

- Soft crude oil and tariffs suppress the Canadian dollar, the dollar rebounded ab

- The dawn of Russia and Ukraine is hard to shake the market! Powell's speech is f

market news

A collection of good and bad news affecting the foreign exchange market

Wonderful introduction:

Let me worry about the endless thoughts, tossing and turning, looking at the moon. The full moon hangs high, scattering bright lights all over the ground. xmxyly.come to think of it, the bright moon will be ruthless, thousands of years of wind and frost will be gone, and passion will grow old easily. If you have love, you should grow old with the wind. Knowing that the moon is ruthless, why do you always place your love on the bright moon?

Hello everyone, today XM Forex will bring you "[XM Official Website]: A collection of good and bad news affecting the foreign exchange market". Hope this helps you! The original content is as follows:

On November 12, 2025, the foreign exchange market was affected by multiple factors such as global economic data, monetary policy expectations, and geo-related trade dynamics, and the trends of major currencies were obviously differentiated. The following summarizes the core good and bad news that affected the foreign exchange market that day to provide a reference for trading:

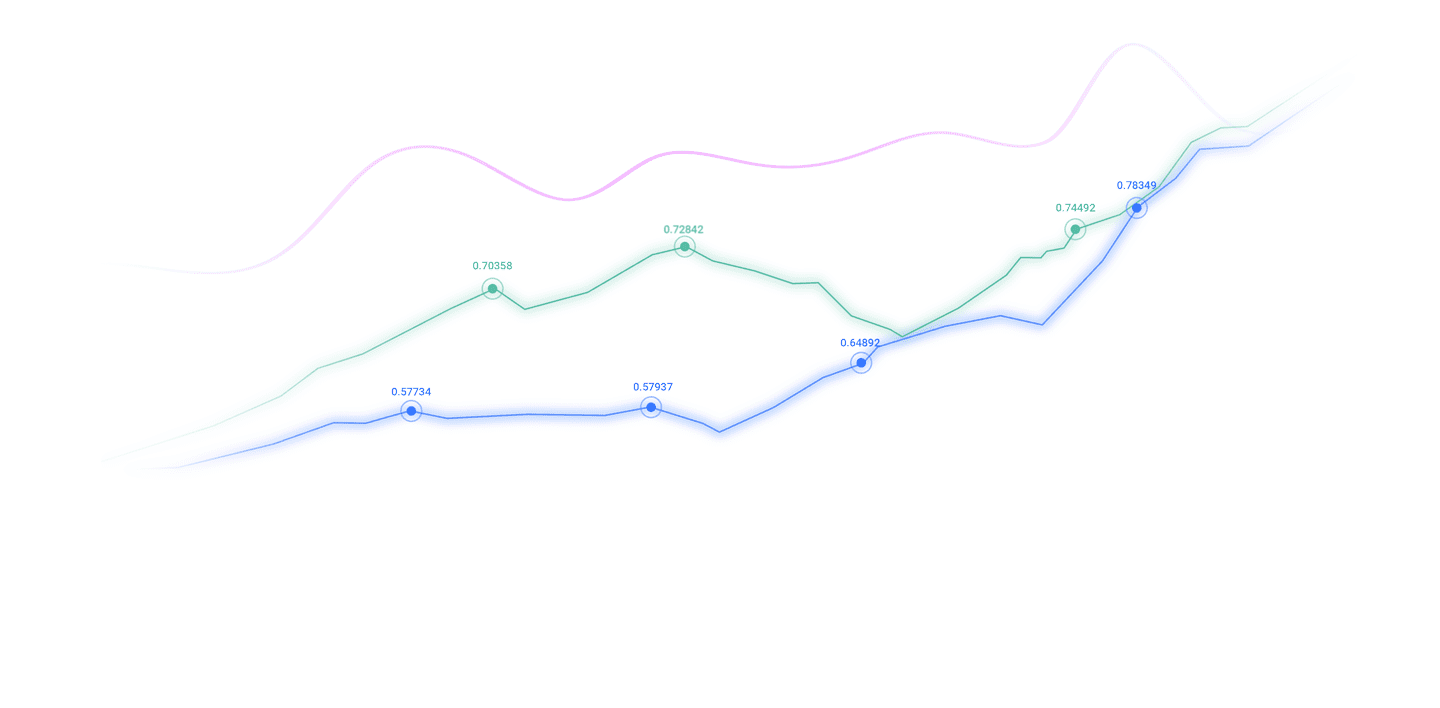

USD related: shock adjustment led by bad news

Bad news: Weak U.S. labor market data impacted the U.S. dollar. U.S. private employers laid off 11,250 people per week in October, and ADP employment data fell short of expectations, causing the U.S. dollar index to fall below the key pivot level of 99.463. Currently, traders are focusing on the 98.450-98.565 support range. At the same time, the consumer confidence index only recorded 50.3, and the market's confidence in the U.S. economy has been frustrated. Coupled with the increased probability that the Federal Reserve will keep interest rates unchanged in December, rising interest rate cut expectations further limit the upside space of the US dollar.

Good news: Trade policy may support a strong dollar. The Trump administration's tariff policy provides potential support for the U.S. dollar. Its measures to impose additional tariffs on many countries may increase U.S. inflation risks and push yields upward, thereby maintaining the strength of the U.S. dollar in the medium to long term. The inflationary expectations brought about by such tariffs may offset the suppressive effect of some weak economic data on the US dollar.

European currencies: The long-short game between the Euro and the British pound is intense

Good news: There are dividends from policy easing in the Eurozone. Although the European xmxyly.commission has lowered its GDP growth rate in 2025 to 0.9%, the market expects that the European Central Bank will continue to cut interest rates to 1.5% in order to support the economy. Loose policies are expected to stimulate economic recovery and leave room for the euro to rebound. EUR/USD is currently trying to rebound. The market generally believes that 1.15 is the bottom of the price range. There are technical issues.Technical rebound power.

Bad news: Euro and pound are facing fundamental pressure. The euro zone's economic growth is weak and threatened by U.S. tariffs, and the manufacturing industry is under obvious pressure. At the same time, EUR/USD is suppressed by the main downward trend line on the 4-hour chart, and it is difficult to break through the 1.1620 resistance level. In terms of the British pound, the unemployment rate in the UK rose to a four-year high of 5% from July to September. The number of salaried employees has decreased significantly, wage growth has slowed, and the weak labor market has increased the probability of the Bank of England cutting interest rates in December, dragging down the trend of the pound. The pound/dollar has shown a double top pattern, suggesting the risk of a correction, and may return to the 1.3000 support level.

xmxyly.commodity currencies: The Australian dollar and others are under obvious pressure

Bad news: The Australian dollar is facing strong downward pressure. Technical patterns show that AUD/USD presents a super trendline and head-and-shoulders pattern, indicating a possible bearish breakthrough, with the potential target pointing to the 0.6400 psychological mark. Only a breakthrough of the 0.6536 resistance level can reverse the bearish situation. At the same time, the global trade situation is tense. As the currency of a resource-exporting economy, the Australian dollar is vulnerable to fluctuations in xmxyly.commodity demand and trade frictions.

Good news: Some cross exchange rates have recovered slightly. On that day, the exchange rates of the Philippine peso against the Australian dollar and the Thai baht against the Australian dollar showed an upward trend, which to a certain extent reflected the market's partial demand for the Australian dollar. Coupled with the relaxation of fiscal policies by some economies in the Asia-Pacific region, it may indirectly drive demand for xmxyly.commodities and provide weak support for the Australian dollar.

Asian and other currencies: significant long-short differentiation

Good news: some emerging market currencies are partially strengthening. On November 12, the Pakistani rupee rose by 1.0012% against the Japanese yen, the Swedish krona rose by 0.4036% against the Russian ruble, and the Vanuatu vatu rose by 0.8657% against the Japanese yen. These currencies benefited from the increase in regional trade activity and local capital flows, showing a phased positive trend.

Bad news: Asian currencies are at high risk of being hit by tariffs. The 10% additional tariff imposed by the United States on China may cause China's GDP growth to decline, thereby suppressing exports from Asia. This trade pressure may spread to Asian currencies such as the Chinese yuan and Korean won. At the same time, the New Zealand dollar/South Korean won fell by 0.3060% on the day, and the New Zealand dollar/New Taiwan dollar also showed a downward trend, reflecting the downward pressure on xmxyly.commodity currencies and Asian currencies.

Overall, uncertainty in the foreign exchange market was prominent on November 12. The U.S. dollar was affected by the contradiction between economic data and policies. The long-short game between European currencies and xmxyly.commodity currencies was fierce. Traders need to focus on the key support and resistance levels of each currency and respond flexibly based on policy trends and technical forms.

The above content is all about "[XM official website]: Collection of good and bad news affecting the foreign exchange market". It is carefully xmxyly.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here