Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold has been silent for too long, so it is time to make big moves!

- Gold bulls remain strong, and the decline in the early trading continued to rise

- Crude oil price fluctuations are still limited to yesterday's range, and market

- Practical foreign exchange strategy on August 26

- Market sentiment is sluggish, dollar-JPY bulls are under pressure

market analysis

Weak employment data dampens market sentiment, dollar will remain under pressure

Wonderful introduction:

The moon waxes and wanes, people have joys and sorrows, life changes, and the year has four seasons. If you survive the long night, you can see the dawn, if you endure the pain, you can have happiness, if you endure the cold winter, you no longer need to hibernate, and after the cold plums have fallen, you can look forward to the new year.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market xmxyly.commentary]: Weak employment data hits market sentiment, and the US dollar will continue to be under pressure." Hope this helps you! The original content is as follows:

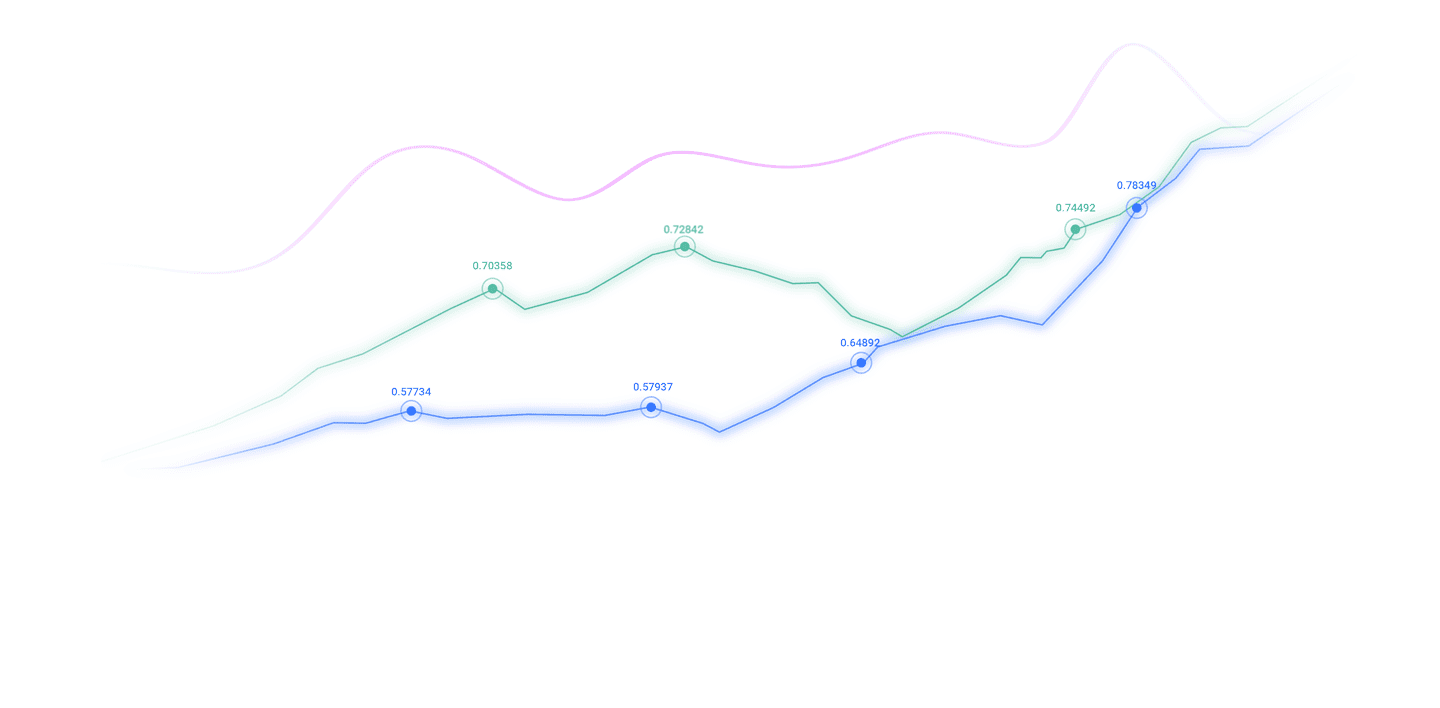

In Asian trading on Wednesday, the U.S. dollar index fluctuated around 99.48. The U.S. dollar generally fell against the euro and the Japanese yen on Tuesday, with the U.S. dollar index falling 0.24% to 99.39. The market is concerned that the U.S. labor market may deteriorate, and it is expected that economic data to be released after the government shutdown ends may further confirm the economic slowdown. The market currently believes that the probability of the Federal Reserve cutting interest rates in December is 67%, and this expectation puts pressure on the dollar. Meanwhile, the euro found support as the European Central Bank's key interest rate was expected to remain unchanged until 2027, while the Federal Reserve was expected to ease monetary policy. Investors need to pay attention to news related to the U.S. government shutdown. In addition, New York Fed President Williams, Philadelphia Fed President Paulson, Fed Governor Waller, Atlanta Fed President Bostic, and Boston Fed President Collins will each deliver speeches this trading day. Investors need to pay attention.

Analysis of major currency trends

USD: As of press time, the US dollar index is hovering around 99.48. As employment data weakens and expectations of a Federal Reserve interest rate cut increase, it may be difficult for the US dollar to regain its upward momentum if the upcoming government data fails to bring bullish surprises. From a technical perspective, there is no obvious support for the downward path after falling below 99.463. The near-term downside target is the October 28 major low of 98.565, with the 50-day moving average of 98.450 just below it. Unless the dollar can move back above the pivot level and hold, bears may continue to push towards these support areas.

1. Hungarian Prime Minister: The meeting between the Russian and American presidents is still on the agenda

On the 11th local time, Hungarian Prime Minister Orban said in a program that relevant negotiations around the meeting between the Russian and American presidents are ongoing and progress has been made, and the Budapest Peace Summit is still on the agenda. The Hungarian government is in contact with Russia. Orban said that the current crux of the relevant negotiations is related to territorial issues.

2. Director of the White House National Economic Council: Some October data may be lost foreverLoss

Kevin Hassett, director of the White House National Economic Council, said that the record-length government shutdown means that some economic data that should be collected in October may never be recorded, making it difficult to fully assess the health of the U.S. economy. "It's my understanding that some of the surveys were actually never xmxyly.completed at all, so we may never know what happened that month," Hassett said Tuesday. "We may have to go through a cloudy period until the data agencies resume operations." Statistical agencies, including the Bureau of Labor Statistics and the Census Bureau, have been unable to collect data during the government shutdown, leaving some reports that rely on manual collection methods vulnerable. Risks are growing that the U.S. Bureau of Labor Statistics will not be able to release the Consumer Price Index (CPI) for October, while economists are also worried about whether another survey on the unemployment rate will be released.

3. Analyst: If Australia’s unemployment rate rises in October, the Reserve Bank of Australia will face a xmxyly.complicated situation

Analyst James Glynn said that Australia’s October employment data will be released on Thursday and will become the focus of the currency market this week. Economists expect the unemployment rate to fall to 4.4% from 4.5% in September, which would ease concerns about a weakening job market. The economy is expected to add about 20,000 jobs this month. However, if the unemployment rate continues to rise, it will xmxyly.complicate the RBA's response, as the bank is currently busy dealing with new inflationary pressures and seems to have no time to take care of other matters for the time being.

4. The CFPB is blocked from withdrawing funds from the Federal Reserve and may not have the funds to continue operating next year

The U.S. Consumer Financial Protection Bureau (CFPB) told the federal court on Monday that the Trump administration has relied on a new legal opinion to prevent it from withdrawing funds from the Federal Reserve, which will cause the agency to run out of funds before the end of the year. The CFPB said the Department of Justice has ruled that the CFPB’s current funding disbursement process is illegal under a new interpretation of the term “consolidated revenue” in the Dodd-Frank Act. The new legal review equates revenue with profits rather than income, essentially eliminating the Fed's ability to fund the CFPB. The CFPB expects to have sufficient funds to continue operations until at least December 31. The move is the latest in a series of actions by the Trump administration that many consumer advocates say are intended to xmxyly.completely dismantle the CFPB. White House budget director Walt said last month he believed he could close the agency "within the next two or three months."

5. British labor market data is weaker than expected and expectations for a rate cut in December have risen to 85%

The weakness in the British labor market is prompting more economists to predict that the Bank of England will cut interest rates in December. This speculation makes the British 10-year government bond expected to record its best single-day performance since June. JPMorgan's Allan Monks is now calling for action in December rather than February next year as previously forecast, joining investors including Goldman Sachs Group Inc, ING Group AG and Nomuraholdings included in the ranks. Money market traders see about an 85% chance of a rate cut before the end of the year, and those bets have pushed the 10-year bond yield to 4.37%, near its lowest point this year. The Bank of England has lagged its major peers in cutting interest rates, with its path xmxyly.complicated by persistent UK inflation and sticky wage data. But signs in recent weeks have suggested both headwinds are easing, fueling bets for action before Christmas. Monks wrote in a note: "The risk of an inflation surprise in the next two releases remains and could call the timing into question, but the (unexpected) move would need to be significant enough to offset September's data and dominate the latest labor market news."

Institutional View

1 .Bank of France: The economy is expected to grow only slightly in the fourth quarter, with political uncertainty causing a drag

The Bank of France said that the French economy "will grow slightly in the fourth quarter" and that high political uncertainty led to a slowdown in expansion in November, but the Bank of France did not give specific figures in its monthly forecast released on Tuesday. The Bank of France said in its routine survey that major investment projects in France are expected to slow down in November due to the significant budget vote and the severe international situation. The report stated: "Affected by the political situation, industrial orders are generally low and uncertainty remains high."

2. ABN AMRO: The politicization of U.S. institutions threatens the U.S. dollar's global reserve status

Economists at ABN AMRO said in a report that the politicization of U.S. institutions under the Trump administration and the pressure on independent institutions pose risks to the U.S. dollar's dominance as the global reserve currency. They pointed out that the decline of U.S. institutions has continued at a high speed since the beginning of this year, and the extent to which the U.S. dollar reserve system remains trustworthy cannot be ignored. The White House is firing oversight agencies, prosecuting political opponents, dismantling oversight and restructuring agencies in deeply partisan ways. That raises questions about whether the United States can continue to maintain the rules-based, diverse institutions and strong markets that attract investment there and support the dollar, they said.

3. ABN AMRO: The political risk of the far-right party xmxyly.coming to power will negatively affect the pound

Economists at ABN AMRO said in a report that a major risk facing the British bond market and the pound is that the far-right British Reform Party may win the election in 2029. They point out that the party currently leads the polls and is likely to gain a parliamentary majority thanks to Britain's age-old first-past-the-post electoral system. They said: "The Reform Party threatens to exert the same type of political pressure on the Bank of England that we are now seeing in the United States on the Federal Reserve." They believe that because the United Kingdom lacks the "arrogant privilege" of the dollar as the world's dominant currency, this political risk could have a negative impact on the government bond market and the pound.

The above content is about "[XM Foreign Exchange Market xmxyly.commentary]: Weak employment data hits the marketSentiment, the U.S. dollar will continue to be under pressure" is carefully xmxyly.compiled and edited by the editor of

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here