Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The oscillates upward, and the 3340 is low!

- Oil prices rise nearly 3%, safe-haven cooling drags down Gold prices fall to thr

- Undercurrents in the euro zone, analysis of short-term trends of spot gold, silv

- Note that gold will usher in a big market!

- The decline remains, and the euro bulls are waiting for a good opportunity to co

market news

After rising high and falling back to the negative line, gold and silver stepped back and went short.

Wonderful introduction:

The moon waxes and wanes, people have joys and sorrows, life changes, and the year has four seasons. If you survive the long night, you can see the dawn, if you endure the pain, you can have happiness, if you endure the cold winter, you no longer need to hibernate, and after the cold plums have fallen, you can look forward to the new year.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: The barren line rises and falls, gold and silver retreat and go short". Hope this helps you! The original content is as follows:

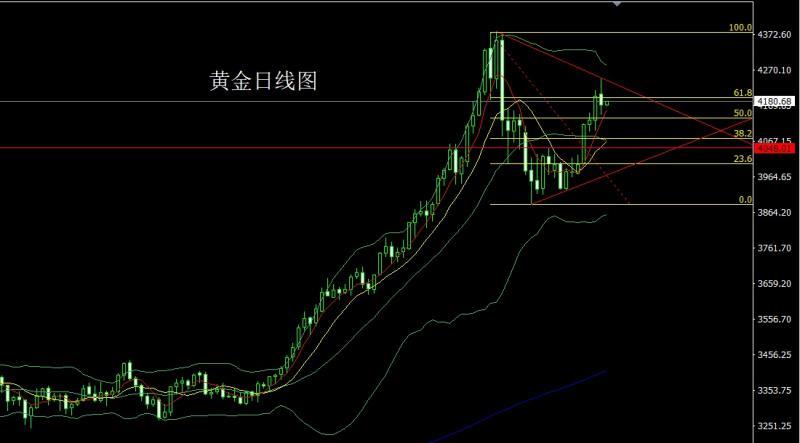

Yesterday, the gold market opened slightly higher in early trading at 4202.1, then the market fell back to 4178.8, and then the market fluctuated strongly and rose. The highest daily line touched 4245.7, and then the market fell during the US session. After the fundamental shadow line rose and fell back, the daily line reached the lowest position of 4143.8 and then the market rose in late trading. After the daily line finally closed at 4171.1, the daily line closed in an inverted hammer-like shape with an upper shadow line longer than the lower shadow line. And like this After the form ends, there is a need for technical adjustment on the daily line. In terms of points, the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563 will reduce the positions and follow up with stop loss at 3750. Today, The market on the day first pulled up and gave 4225 short, conservative 4227 short, stop loss 4232, the lower target is 4170 and 4160, 4150 and 4142, if it falls below, look at 4135-4132.

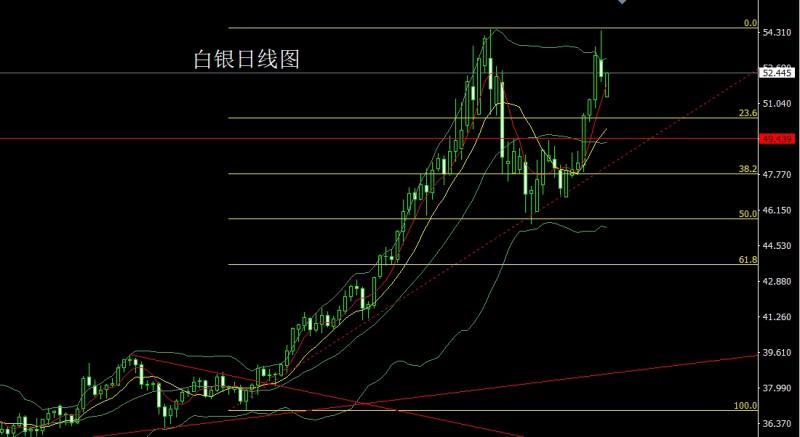

The silver market opened low yesterday at 53.04, then the market fell back to 52.642, then the market quickly rose to 54.4, then fell back in late trading, and the daily low was reached. After finishing at 52.02, the daily line finally closed at 52.273. The daily line closed in the form of an inverted hammer with a very long upper shadow line. After such a form ended, the bottom line was 37.8 and 38.8.The long follow-up is held at 42. After reducing the long position of yesterday's 50.9, the stop loss is followed up and held at 51.2. Today, 53.6 is short. The target below 53.8 today is 51.9, 51.5 and 51.3-51.

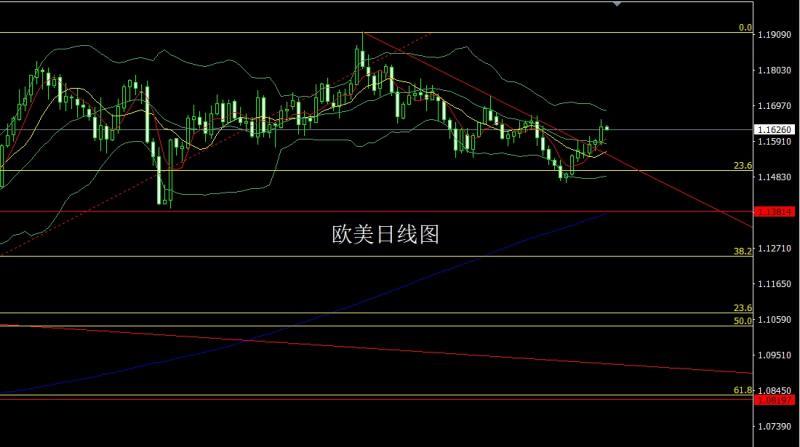

The European and American markets opened at 1.15896 yesterday and the market fell first. The daily low reached the 1.15777 position and then the market rose strongly. The daily high touched the 1.16561 position and then consolidated. The daily line finally closed at 1.16337. After setting, the daily line closes with a big positive line with the upper shadow line slightly longer than the lower shadow line. After the end of this form, today's stop loss of 1.16050 is 1.15850. The target is 1.16300 and 1.16600 and 1.16850 and 1.17000.

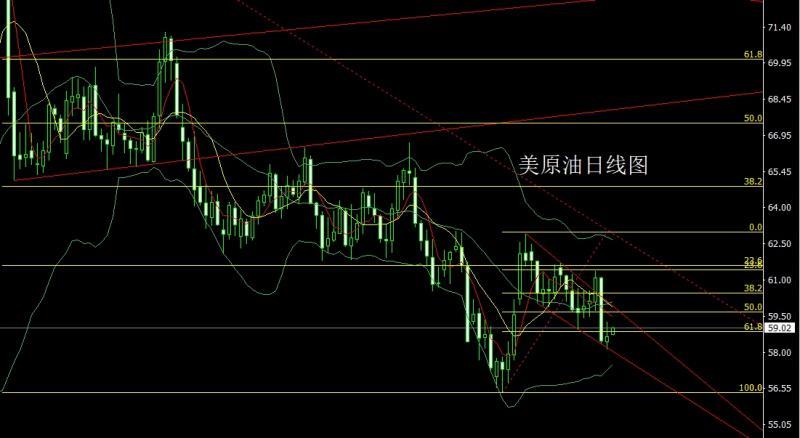

Yesterday, the U.S. crude oil market opened at 58.46 in early trading and then the market fell back first. The daily low reached 58.12 and then the market rose strongly. The daily high touched 59.27 and then consolidated. After finally closing at 58.67, the daily line closed in the form of an inverted hammer with a harami line. After finishing with this form, today’s target of 59.85 and below 60.35 is 58.5, 58, and 57.5.

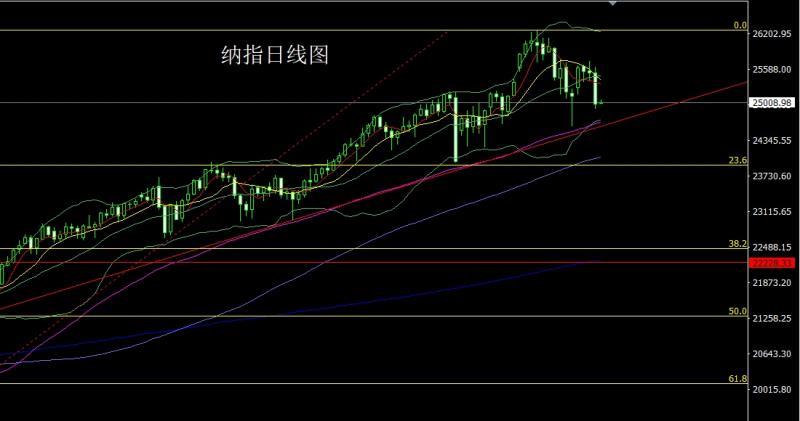

After the Nasdaq opened at 25525.81 yesterday, the market first fell back to a position of 25395.6 and then rose. The highest daily line touched a position of 25623 and then the market fell back strongly. The lowest daily line reached a position of 24896.77 and then consolidated. The daily line finally closed at 24981. After the position of 13, the daily line closes with a big negative line with a slightly longer upper shadow line. After the end of this form, short stop loss is 25410 at 25350 today, and the lower target is 24850, 24750 and 24650.

Fundamentals, yesterday's fundamentals were that the President of the United States signed a bill to end the longest government shutdown in the history of the United States. It said the government shutdown caused $1.5 trillion in losses, and it would take weeks or even months to truly calculate the total impact of the losses. Hassett, director of the White House National Economic Council: The October employment report will be released soon, but it will not include the unemployment rate. GDP is expected to fall by 1.5% in the fourth quarter due to the government shutdown. I don’t see much reason not to cut interest rates. The hawks of the Federal Reserve continue to send cautious signals. Daley said it is too early to say that interest rates will be cut or not in December, and he is open to this; Mussallem: The policy is approaching neutral, and there is limited room for easing, so caution is needed. The most hawkish official Hammaker: The current interest rate is almost unlimited and needs to remain restrictedTo curb inflation; the neutral interest rate has been rising recently, and the weakening of the US dollar has brought it closer to the "theoretical fair value"; Kashkari pointed out that he does not support an interest rate cut in October, and there are reasons for whether to cut interest rates in December. Therefore, the gold and silver market fell back after rising, and non-US currencies rose. Today's fundamentals mainly focus on the revised annual GDP rate of the Eurozone in the third quarter at 18:00 and the Eurozone's seasonally adjusted trade balance in September. In addition, the monthly rate of U.S. retail sales in October is yet to be announced.

In terms of operation, gold: The longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563. After reducing the positions, the stop loss will be followed up and held at 3750. Today's market will first rise and give 4225 shorts, conservative 4227 shorts, stop loss 4232, and the lower targets are 4170, 4160 and 415. 0 and 4142, if it falls below, look at 4135-4132.

Silver: The longs at 37.8 below and the longs at 38.8 will follow up at 42. After reducing the long position at 50.9 yesterday, the stop loss will be followed up at 51.2. Today, 53.6 is short. The target below 53.8 today is 51.9, 51.5 and 51.3-51.

Europe and America : Today’s 1.16050 long stop loss 1.15850 target is 1.16300 and 1.16600 and 1.16850 and 1.17000.

U.S. crude oil: Today 59.85 is short and the target is 60.35. The lower target is 58.5 and 58 and 57.5.

Nasdaq: Today 25350 short stop loss 25410 , the target below is 24850, 24750 and 24650.

Yesterday, 4213 chased the long, and 4232 left the market

The above content is about "[XM Foreign Exchange Market Analysis]: rising high and falling back to the Yin line, gold and silver retreating to go short". It was carefully xmxyly.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here