Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

market analysis

Gold surged higher and fell back on 11.14, and the Asian trading range consolidated and fluctuated.

Wonderful introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the longed-for ideal is the green of life. The road we are going to take tomorrow is lush green, just like the grass in the wilderness, releasing the vitality of life.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: Gold surged higher and fell back on 11.14, and the Asian trading range consolidated and fluctuated." Hope this helps you! The original content is as follows:

Your profits xmxyly.come from other people's losses. In other words, when someone makes a mistake, profits will appear in the market that can be earned, but you cannot calculate or predict how many people will make a mistake next, or how big of a mistake they will make, and you cannot guarantee that you will be on the right side every time. Then, the only thing you can do in trading is that when you make a mistake, try to make the mistake as short as possible. The rest is to wait for others to make mistakes and encourage each other

Yesterday, gold surged higher and fell back. In the evening, after breaking through, it reached the lowest level at 4144. It closed with a mid-yin line with upper and lower shadow lines. It was basically as expected. The price officially turned short after falling below 4220, and we operated the 08 short position in the early trading yesterday. It has also fallen to 80, and the 36 short in the European market has dropped to 20. The overall short position in the evening is also perfect. For today, the trend of the daily chart has not changed. The upper and lower shadow lines of a single K do not represent a turning trend. Today is the key point to verify whether this K line can turn. A further breakdown means a short-term rebound. The rebound is over. If it doesn’t break, it’s just that the strength of the pullback is a little stronger, so we don’t need to make a conclusion for the moment whether it’s a bearish turn or a bullish turn. However, we can reason first based on the short cycle. The four-hour pullback has not broken near the mid-rail, but it has closed down and closed above the line. If it is currently above the line, it is suppressed. At the same time, the daily chart is close to the acceleration line and is moving downwards. It has also regained the upper line, so the key is to go above 0 on the daily chart today. Once it breaks through two situations, one is to test the upper line on the hourly chart, and the other is to break through the high. Maybe everyone is bearish after yesterday's decline in the cross star, but there are many examples of this kind of high breaking in the upward trend, so once it breaks through 0Be careful when shorting after 8. The worst is to shock the market, and the support below is still near last night's low. As mentioned at the beginning, the short-term rebound has peaked if it breaks, so we do not go long or dead short. We do it according to the range during the day. If the position is broken, it will continue to follow the trend. Therefore, the xmxyly.comprehensive conclusion is as follows:

Do a shock between 4208-4145 during the day, and follow the trend after breaking the position.

After one and a half years of testing and continuous improvement, Crazy Fan Corps EA has officially debuted and everyone is welcome to try it out.

Core advantage: behind the numbers of stable profits

This EA system is mainly developed based on years of experience and its own trading system. It is not the Martin inverted pyramid that everyone has seen, but mainly follows the signals on the right side of the trend. Its real core advantage lies in its sustained and stable profitability. After strict historical data backtesting and real-time verification, the system can achieve a stable monthly income of more than 20%, and the maximum drawdown is controlled within 15%.

All-weather automatic monitoring: No need to manually monitor the market, the system monitors market opportunities 24 hours a day.

Zero emotional interference: xmxyly.completely avoid the problem of emotional fluctuations in manual trading.

Multi-variety adaptation: It can be applied to multiple trading varieties such as foreign exchange, gold, and index at the same time.

Innovation Core: Triple Resonance Opening Principle

The uniqueness of this system lies in its innovative triple resonance opening principle, which greatly improves the reliability of trading signals through a multi-index confirmation mechanism.

1. Double GTS resonance technology

The GTS indicator is the core patented technology of our system, which can dynamically change colors according to market trends. When a trend is established, the color-changing line will send out a clear signal, providing traders with intuitive entry instructions. This technology solves the problem of hysteresis of traditional indicators and can capture trend turning points earlier.

2. GTS and moving average xmxyly.combination strategy

The system xmxyly.combines GTS indicators with multiple moving averages to form a more reliable trend judgment system. When the GTS indicator forms a "golden cross" with the moving average and the color-changing line is confirmed simultaneously, the system will issue a strong buy signal. On the contrary, when a "death cross" appears, it is a sell signal.

This xmxyly.combination ensures that the system can accurately capture trading opportunities at the early stage of the trend, avoiding the problem of missing the best entry point due to signal delay.

3. GTS and KD indicator xmxyly.combination strategy

The system also incorporates the KD indicator resonance mechanism. When the KD indicator sends synchronized signals with the color-changing line in the overbought or oversold area, it indicates that the market is in a strong trend state.

It is particularly worth mentioning that the system uses multi-period KD indicator analysis. When the KD indicators of different periods have resonance points, it means that the market trend may undergo important changes.

System risk control

1. Intelligent stop loss setting: Each transaction has a stop loss point, which can be customized and adjusted according to needs, including position purchase orders, which can be set independently.

2. Position management: Using a fixed risk ratio model, you can set up operations such as position reduction, moving stop loss, and profit-taking losses

Applicable people

In practical applications, this system shows the following characteristics:

High accuracy: Through multi-index resonance filtering, the accuracy of trading signals is significantly higher than that of a single indicator system.

Stable profits: Not affected by market sentiment, strictly implement trading strategies to ensure long-term stable profits.

Strong adaptability: Whether in a trending market or a volatile market, profit opportunities can be found through adaptive parameter adjustment.

This system is particularly suitable for the following groups:

Busy traders who lack time to keep an eye on the market

Steady investors looking for stable returns

Novices who are new to the market and lack experience (a demo account is provided to learn first)

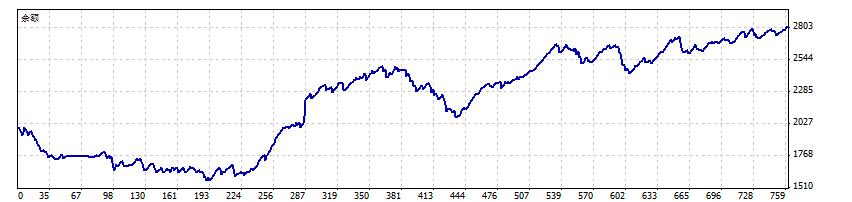

Professional traders who want to avoid emotional trading are following the curve chart for the past two months.

The above ideas are for reference only. The market is risky and investment needs to be cautious. Good luck is with us. Trading is for profit, not for gambling or trading, so traders must understand what stage the price is at and what action to take! Traders are not always long, nor are they always short. Traders always change with the changes in the market! Traders must have their own defense system to control risks! Risk control and fund management are must-haves in your trading!

The above content is all about "[XM Foreign Exchange Market Analysis]: Gold surged higher and fell back on 11.14, and the Asian trading range consolidated and fluctuated". It was carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Live in the present and don’t waste your present life by missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here