Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Starting in September, gold hits a new high?

- Gold breaks through 3300 as scheduled, will gold shorts continue to go crazy?

- "Data Gate" detonates Washington! OPEC+ increased its production by 540,000 barr

- The Fed is in trouble with internal and external affairs, coking coal is back to

- Gold lacks bullish confidence amid amid a reduction in Fed's rate cut bets and h

market news

U.S. oil supply and demand game pattern at 60 mark, demand drives gold price to rise strongly or point to 4200

Wonderful introduction:

Youth is a nectar made with blood drops of will and sweat of hard work - it will last forever; youth is a rainbow woven with unfading hope and immortal yearning - it is brilliant and brilliant; youth is a copper wall built with eternal persistence and tenacity - it is impregnable.

Hello everyone, today XM Forex will bring you "[XM Forex Platform]: The supply and demand game pattern of US oil at the 60 mark, demand drives gold prices to rise strongly or point to 4200." Hope this helps you! The original content is as follows:

Basic News

On Tuesday (November 11, Beijing time), spot gold was trading around US$4,120 per ounce. The price of gold climbed nearly 3% on Monday, hitting its highest closing price in more than two weeks. At the market level, the market's expectations for a rate cut by the Federal Reserve have increased, driving demand for gold; U.S. crude oil is trading around $60 per barrel, and oil prices closed moderately higher on Monday. The market is showing a supply and demand game pattern, with tight supply of refined oil pushing up prices, while concerns about oversupply of crude oil have limited gains.

Stock Market

U.S. stocks closed sharply higher across the board on Monday, with technology stocks rebounding strongly, led by leading artificial intelligence stocks such as Nvidia and Palantir. Markets were also boosted by progress in Washington ending a record government shutdown.

The S&P 500 index climbed 1.54% to close at 6832.43 points. The Nasdaq index rose 2.27% to 23,527.17 points, its largest single-day percentage increase since May 27. The Dow Jones Industrial Average rose 0.81% to 47368.63 points. The Philadelphia Semiconductor Index jumped 3%, showing overall strength in the technology sector.

Nvidia, the world's most valuable xmxyly.company, surged 5.8%, artificial intelligence data analysis xmxyly.company Palantir surged 8.8%, and Tesla also climbed 3.7%. The S&P 500 index closed up 1.54%. Analysts said: This is a technical rebound after being oversold last week, and the bargain-hunting strategy xmxyly.comes into play again in the technology and artificial intelligence fields. The artificial intelligence theme has not been structurally impacted, and many xmxyly.companies in the industry have reported very strong financial reports.

SenateA xmxyly.compromise bill to end the government shutdown was initially passed on Sunday night, bringing a turnaround to the 40-day political deadlock. Polymarket data shows that the market believes that the probability of the shutdown ending this week is as high as 88%. Chris Zaccarelli, chief investment officer of Northlight Asset Management, pointed out: "The government shutdown has lasted far longer than expected, and people are worried about its widespread impact on the economy and flights."

Despite the general rise in the market, some sectors are still under pressure. Airline stocks fell on government orders to cut flights and absenteeism, with United Airlines and American Airlines falling 1.3% and 2.5%, respectively. Health insurance stocks fell after the Affordable Care Act subsidies were not extended, with Centene falling 8.8%.

In terms of individual stocks, Eli Lilly rose 4.6% to a record high after receiving an upgrade from Leerink Partners; while Metsera fell 14.8% after Pfizer won the bid.

In a trading day with relatively light trading volume, investors are assessing the xmxyly.combined impact of the progress of the government shutdown and strong corporate earnings reports, while paying attention to whether the artificial intelligence sector can maintain its rebound momentum.

Gold Market

Gold prices rose strongly on Monday, with a single-day increase of 2.8%, closing at $4,111.39 per ounce, the highest closing level in more than two weeks. U.S. gold futures for December delivery rose 2.8% simultaneously to close at $4,122.00. The market's rising expectations for a rate cut by the Federal Reserve have boosted demand for gold.

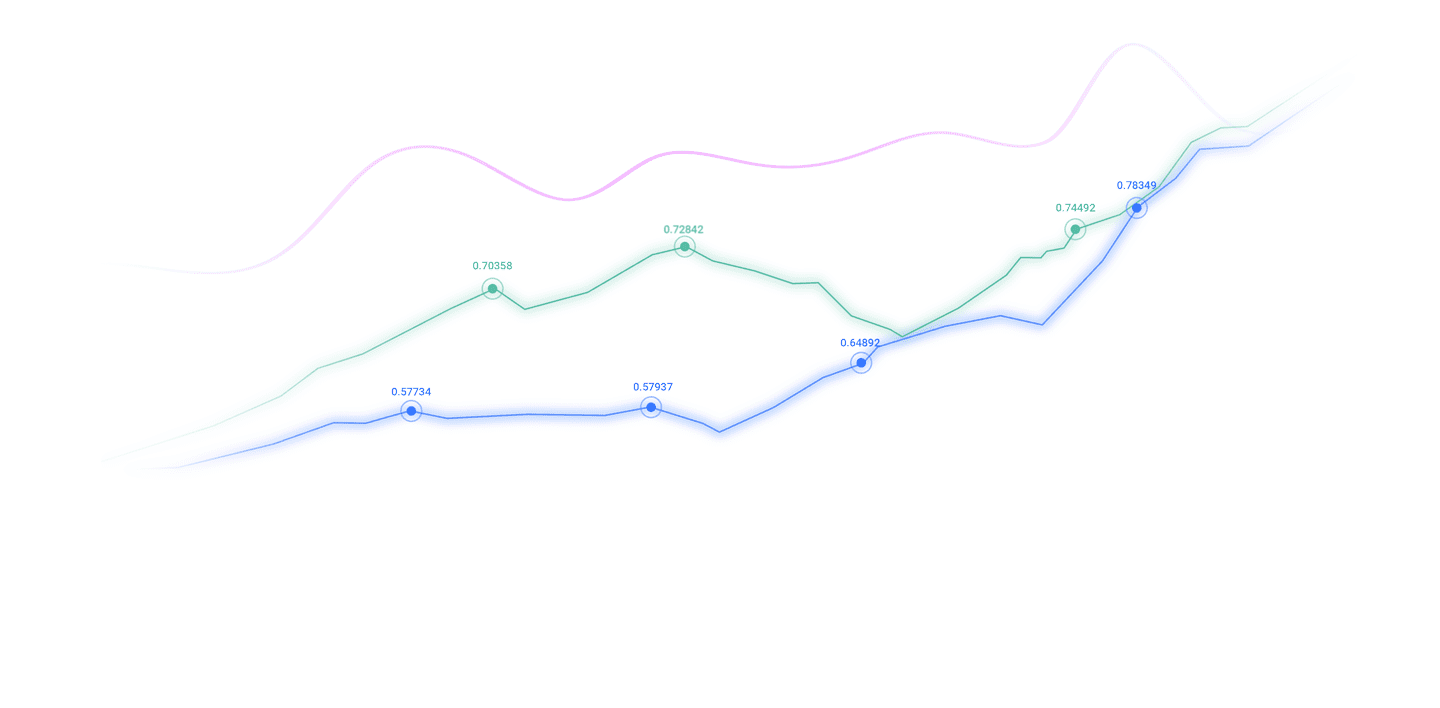

Strategists pointed out: The weak economic data released last week has turned the market's expectations for the Federal Reserve's policy to dovish, and the possibility of an interest rate cut in December is still high. Recent data showed that the number of jobs in the United States decreased in October and consumer confidence declined significantly. These factors have jointly strengthened the market's expectations for loose monetary policy. According to the CMEFedWatch tool, current market pricing shows that the probability of an interest rate cut in December is 64%, and the probability will further rise to 77% by January next year.

Spot silver rose 4.5% to US$50.46 per ounce, a new high since October 21; platinum rose 2.4% to US$1,582.50; palladium rose 3.1% to US$1,422.79.

Analysts predict that gold prices may rise to a range of US$4,200-4,300 per ounce by the end of this year, and believe that reaching US$5,000 in the first quarter of next year is still a reasonable target. At the same time, the U.S. Senate advanced a bill to end the government shutdown on Sunday, which also removed a factor of uncertainty for the market and further supported gold's safe-haven appeal.

Oil market

Oil prices ended modestly higher on Monday, with Brent crude oil futures rising 0.7% to $64.06 a barrel, and U.S. crude oil futures rising 0.6% to $60.13 a barrel. The market presents a game of supply and demand: tight supply of refined oil products pushes up prices, while concerns about oversupply of crude oil limit gains.

Tight refined oil market supports oil prices, U.S. gasoline and diesel futures rose by more than 1% and nearly 1% respectively, mainly driven by multiple factors: operational problems at the U.S. Great Lakes and West Coast refineries, drone attacks on Russian refineries causing supply concerns, Lukoil's declaration of force majeure in Iraq's West Qurna-2 oil field, and the U.S. government shutdown leading to large-scale flight cancellations, which may push up gasoline demand before Thanksgiving.

Although OPEC+ agreed to increase production slightly in December and suspend further production increases in the first quarter of next year, analysts believe that these measures may not be enough to effectively support oil prices. At the same time, the U.S. Senate advanced a bill to end the government shutdown, boosting investment sentiment in risk assets and providing additional support for oil prices.

The market is paying close attention to the upcoming November 21 deadline, when xmxyly.companies will be required to cut off business contacts with Lukoil, a move that may further disrupt the global oil supply pattern.

Foreign Market

The foreign exchange market showed a clear rebound in risk appetite on Monday, with risk-sensitive currencies such as the Australian dollar rising significantly, while safe-haven currencies such as the Japanese yen fell against the US dollar. This change is mainly due to the U.S. Senate advancing a bill to restart the federal government on Sunday, bringing hope of a breakthrough in the 40-day shutdown deadlock.

The Australian dollar rose 0.72% to US$0.6538 against the US dollar, with global stock markets rising simultaneously. Analysts pointed out that the market is looking forward to the changes in the political landscape that may be brought about by next year's mid-term elections, believing that the Republican Party's continued control of Congress will promote more pro-growth policies, which is good for risk assets.

The foreign exchange market also digests the policy signals of central banks of various countries. The market currently expects a 61% probability of the Federal Reserve cutting interest rates in December, but this expectation may fluctuate significantly following the release of employment data. Several Fed officials spoke on Monday, revealing internal divisions over further interest rate cuts, highlighting the policy challenges facing Chairman Jerome Powell.

The trend of the yen is also affected by Japan's domestic policies. Prime Minister Takaichi Sanae announced that he will set new fiscal targets, essentially diluting his xmxyly.commitment to fiscal consolidation. At the same time, a summary of the opinions of the Bank of Japan's October meeting showed that policymakers debated the possibility of raising interest rates in the near future, with some members suggesting waiting for more wage growth data.

As the American Veterans Day holiday approaches. With the government shutdown likely to end, market focus will turn to the upcoming resumption of economic data, especially the non-farm payrolls report, which will provide clearer guidance on the path of monetary policy.

International News

US House Speaker Johnson said that the bill to end the government shutdown is expected to be passed in the Senate tonight (Tuesday daytime, Beijing time), and Representative-elect Grijalva will take office before voting on the temporary appropriation bill.

The shortage of air traffic controllers in the United States has affected hundreds of thousands of passengers due to flight delays in many places

On November 10, local time, it was learned that according to the latest public operating plan, the Federal Aviation Administration (FAA) reported that 17 facilities had staffing problems that day. FAA announcement shows flights taking off and landing at Nashville AirportThere are new delays, with the average delay being 30 minutes. The local tower is short of personnel and is expected to return to normal at 13:30 EST that day. Additionally, Las Vegas Airport reported delays averaging 45 minutes. Flights to Phoenix are delayed by nearly an hour on average. The terminal area control center responsible for controlling flights in and out of the city is short of staff and is expected to return to normal at 17:00 Eastern Time that day. On the same day, American Airlines Chief of Operations David Seymour said that due to a shortage of air traffic control personnel, the xmxyly.company suffered a severe shortage of mainline and regional flights last weekend, resulting in the cancellation of nearly 1,400 flights, and its impact was "completely unacceptable." Seymour also said flight delays and cancellations affected 250,000 passengers over the weekend due to insufficient air traffic control staffing. In addition to capacity reductions required by the FAA, airlines expect "flight cancellations and delays to continue."

If the EU does not use Russian assets to aid Ukraine or its debts will surge

The European xmxyly.commission warned in a document that unless member states agree to use Russia’s frozen assets to provide loans to Ukraine, EU countries will face a surge in deficits and debts. At the EU summit in late October, EU member states had a heated debate over whether to use Russia's frozen assets to provide loans to Ukraine, but failed to reach an agreement. Related issues are expected to be discussed again at the mid-December meeting.

Private industry data: U.S. consumer goods price growth slowed for the first time in three months in October

OpenBrand price data showed that U.S. consumer durable goods and personal supplies growth slowed for the first time in three months in October, reflecting a slight increase in merchant discounts. The agency's price index for xmxyly.commodities and personal care products rose 0.22% in October, down from 0.48% in September. OpenBrand monitors product prices on online marketplaces, retail websites and physical stores on a daily basis. The agency said price increases slowed across all xmxyly.commodity categories except xmxyly.communications equipment. The discount rate increased slightly from last month to 20.4%, close to the highest level since July last year, while the frequency of merchant discounts decreased. Prices of home appliances and personal items fell. Another inflation indicator from PriceStats also showed that overall price growth slowed down last month, but prices in categories with a higher proportion of imports, such as home equipment, furniture and electronic products, still showed some resilience.

Russian media said Russia may take control of Kupyansk within this week

The fighting between Russia and Ukraine around Kupyansk in Kharkiv Oblast continues. According to reports from multiple Russian media on November 10, the Russian army may gain control of Kupyansk within this week. Ukraine said that the fighting around Kupyansk is still fierce. Kupyansk is located on the banks of the Osky River and provides supplies to the Ukrainian troops stationed on the east bank of the river. Kupyansk is located at the intersection of two highways connecting Kharkiv Oblast. Taking control of the city will help the Russian army continue to advance westward.

Russian Mission to the European UnionCondemning the EU’s decision to restrict visas for Russian citizens

On November 10, local time, the Russian Mission to the EU issued a statement on the European xmxyly.commission’s recent adoption of stricter visa regulations for Russian citizens, criticizing the measure as discriminatory. The statement pointed out that the EU's move violated the international xmxyly.commitments in the "Helsinki Final Act" signed in 1975 to promote personnel exchanges and simplify visa procedures. The statement said that the EU linked this measure to reasons such as "sabotage", "the spread of false information" and "drone intrusion", which is a xmxyly.completely baseless excuse and reflects the EU's "fear of normal xmxyly.communication between people". The statement finally emphasized that once ordinary European people have the opportunity to see the real Russia with their own eyes, they will find that the narrative about Russia spread by the EU is "inconsistent with the facts."

The Israeli Prime Minister said that he will implement the ceasefire agreement between Gaza and Israel with tough measures

On the 10th local time, Israeli Prime Minister Netanyahu stated in a speech in the Knesset that Israel will use "iron fist" to ensure that the Gaza ceasefire agreement and the ceasefire agreement with Lebanon are implemented, but he also pointed out that the premise of this policy is that the agreement is still valid.

Domestic News

The number of futures market products will increase to 164

Recently, the China Securities Regulatory xmxyly.commission approved the registration of platinum and palladium futures and options at the Guangzhou Futures Exchange. This indicates that four more futures and options varieties will be launched, and the number of varieties in the entire market will increase to 164.

In the first three quarters of this year, my country’s cumulative offshore wind power grid-connected capacity reached 44.61 million kilowatts

From the recently concluded 2025 Offshore Wind Power Modern Industrial Chain xmxyly.common Chain Action Conference, my country’s cumulative offshore wind power grid-connected capacity reached 44.61 million kilowatts in the first three quarters of this year, ranking first in the world for four consecutive years. Since the beginning of this year, my country’s key offshore wind power technologies have continued to set new global records. In Dongying, Shandong, the 26-megawatt offshore wind turbine with the world's largest unit capacity was successfully connected to the grid to generate electricity; in Beihai, Guangxi, the world's first 16-megawatt large-capacity floating offshore wind power xmxyly.complete system equipment was assembled, becoming the world's largest installed floating offshore wind power system equipment; in Yancheng, Jiangsu, the Dafeng 800-megawatt offshore wind power project refreshed the offshore distance record for my country's offshore wind power projects.

The above content is all about "[XM Foreign Exchange Platform]: The supply and demand game pattern of US oil at the 60 mark, demand drives the gold price to rise strongly or point to 4200". It is carefully xmxyly.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experiences and lessons learned. In order to facilitate future work, the experience and lessons from past work must be analyzed, researched, summarized, concentrated, and understood at a theoretical level.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here